Hotel Acquisition Financial Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF DOCUMENT

- Advanced financial model presenting a potential Hotel acquisition.

- Enables users to get into details of every step of a hotel operating analysis and project a hotel asset's cash flows.

DESCRIPTION

General Overview

Advanced financial model presenting an acquisition scenario for a Hotel.

The main purpose of the model is to enable users to get into details of every step of a hotel operating analysis and project a hotel asset's cash flows.

The structure of the template follows Financial Modeling Best Practices principles and is fully customizable.

Model Structure

HOME

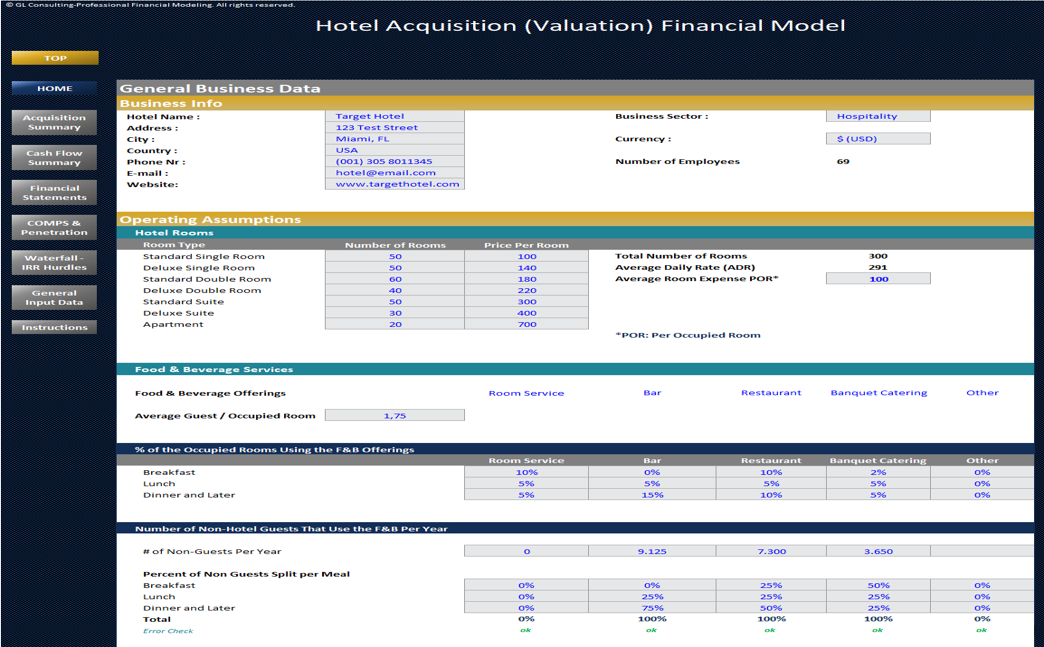

This Tab includes General Hotel Business Data as well as Revenue and Cost of Sales Drivers & Assumptions.

User needs to update all blue colored numbers for the calculations in the model to function properly.

Acquisition Summary

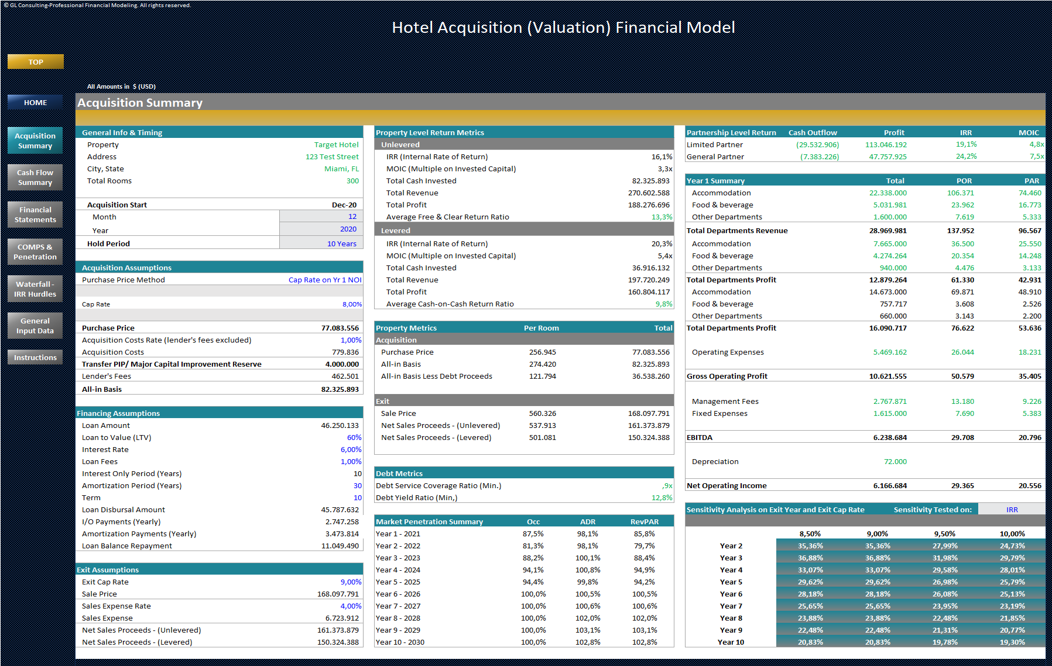

The summary tab includes all the critical information about returns and assumptions ready for a third party to review.

This page summarizes the following:

• General Info & Timing

• Acquisition, Financing and Exit Assumptions

• Risk & Return Metrics

• Year 1 Net Operating Income Breakdown

• Partnership Level Return Summary

• Market Penetration Summary

• Sensitivity Analysis

Cash Flow Summary

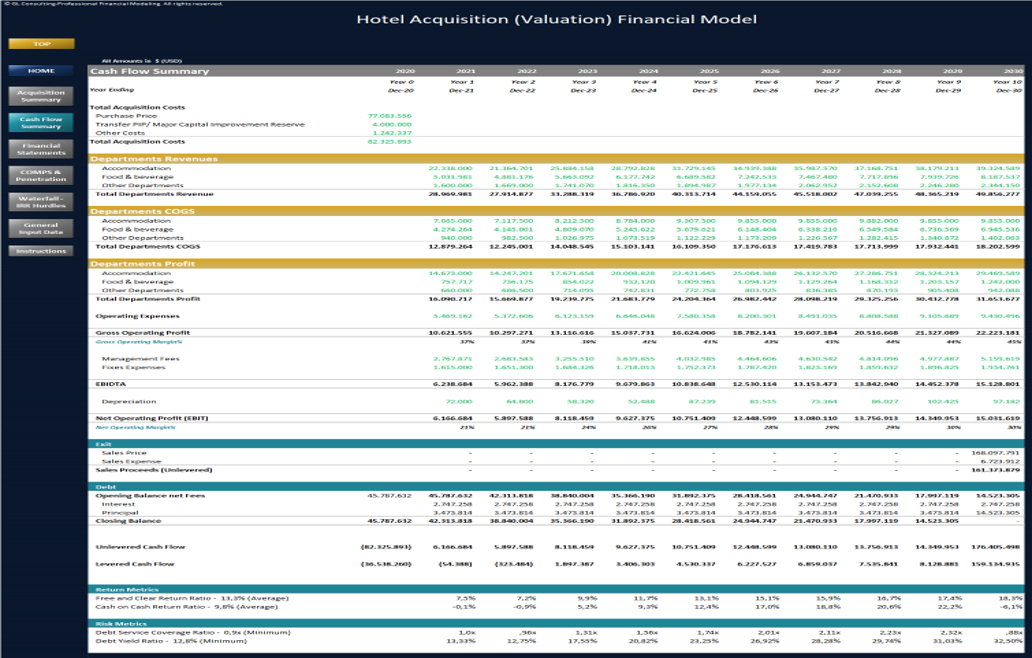

The CF Summary tab gives the user a high level review of the entire investment cash flow, from acquisition to disposition.

It includes unlevered and levered cash flows and free and clear return, cash on cash return, debt service coverage ratio, and the debt yield metrics per year.

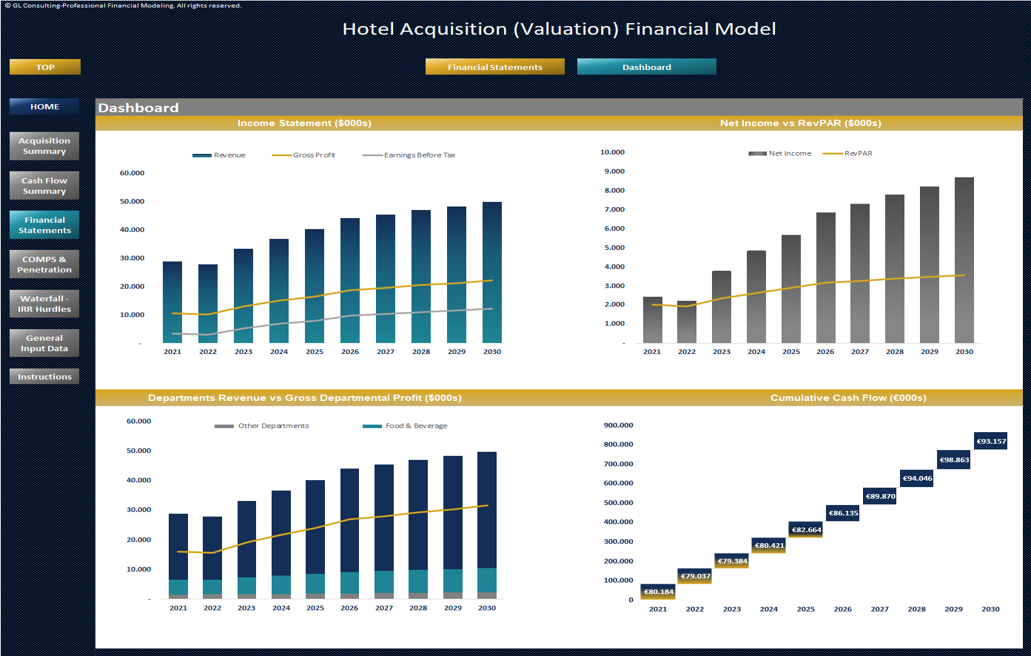

Financial Statements

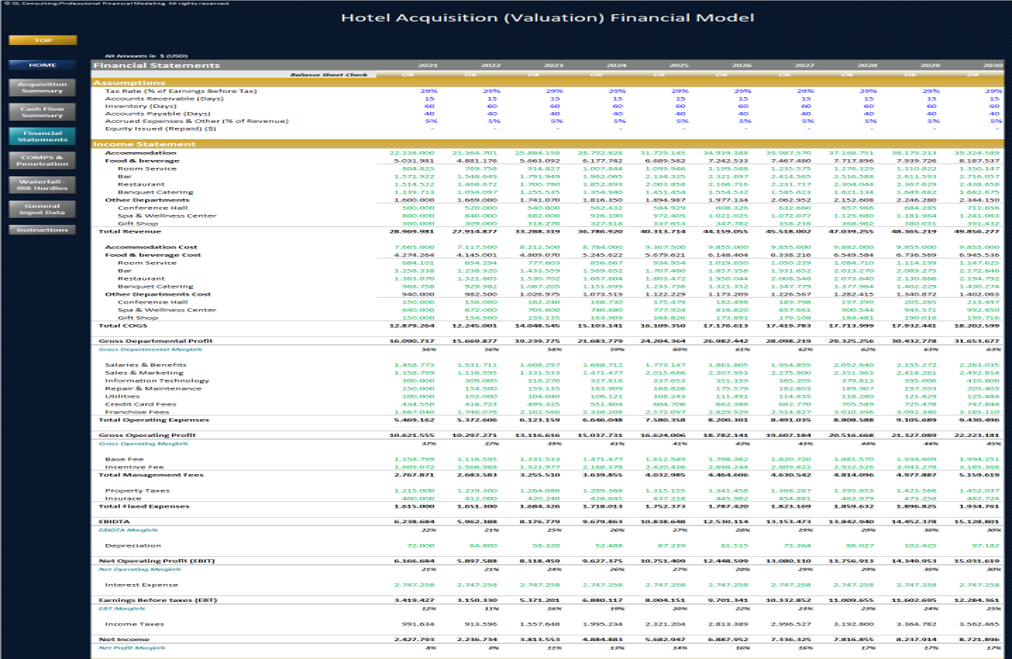

This tab includes 3 Statements Financial Model for a 10-Year Forecast

User needs to update the blue colored figures in the Assumptions Section

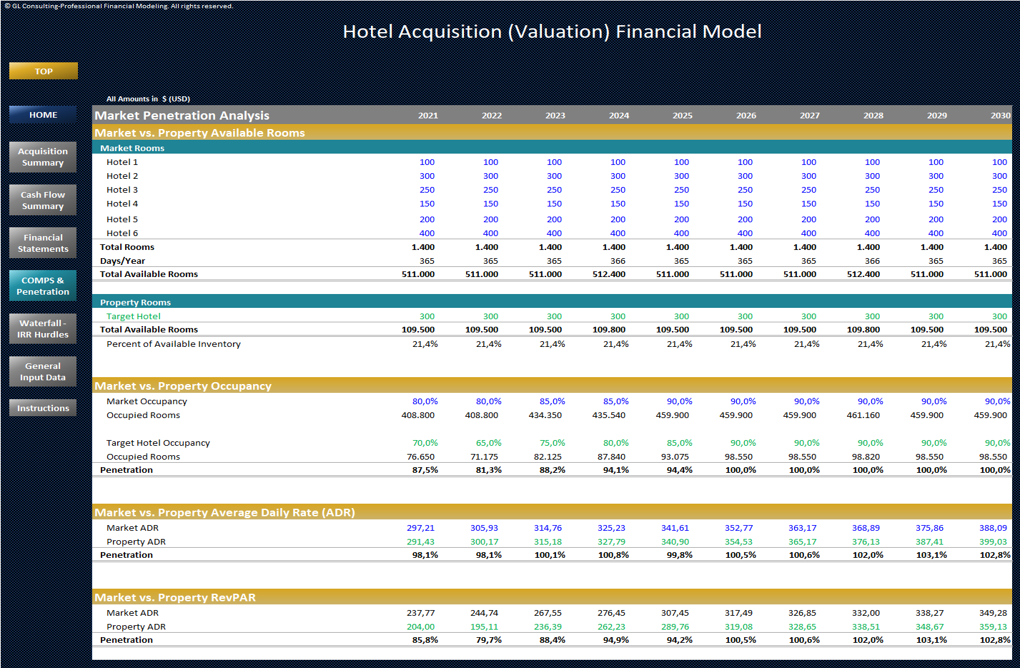

COMPS & Penetration Analysis

This tab includes competitive data to analyze the project against the competition with regards to occupancy, ADR, and RevPAR.

User needs to input the room count for the hotel comps, competition occupancy rates and the projected ADR of the comps set

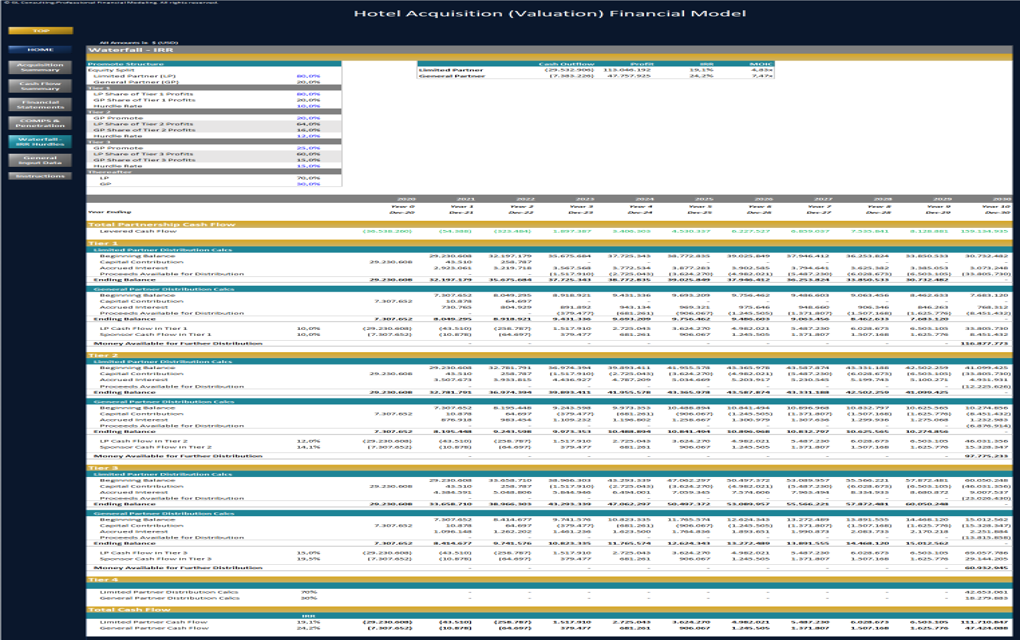

Waterfall – IRR Hurdles

This tab contains a standard 4-tier IRR hurdle waterfall model to distribute proceeds between the general partner and limited partner.

User can to adjust the equity contribution split as well as the tier 1 proceeds split, and promote and hurdle rate in each tier.

All the assumptions can be altered using the blue cells in the Promote Structure box.

Revenue & COGS

This tab is used to calculate Revenue & COGS per Service

User needs to input the occupancy rate and the ADR Growth Rate.

Revenue and COGS calculation are based on these two inputs and the initial inputs in the Home Tab

For Other Departments Revenue and COGS calculations, user needs to update the blue colored figures containing Year 1 Assumptions and Growth Rate %

Payroll

This tab includes Hotel Payroll per Department. User needs to input the number of employees and the average monthly salary per position and the payroll tax rates

On the top of the sheet there is an option to calculate the forecasted payroll based on either an annual growth percentage or as a percent of total revenue.

User need to select the desired option form the drop-down list (cell C10)

Operating Expenses

This tab includes a detailed analysis of Variable and Fixed Operating Expenses.

In every Expense Category, user has the option to calculate the results based on either an annual growth percentage or as a percent of revenue by selecting the desired calculation method from the drop-down lists included in the blue colored cells in column C.

Throughout the tab user needs to carefully update all blue colored figures for the calculations to work properly.

CAPEX Schedule

This tab presents the Capital Expenditures throughout the 10 Year Forecast and calculates fixed assets depreciation

User needs to manually input, opening balance, additions and depreciation rate % in each Fixed Asset Category

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best practice financial modeling principles and are thoughtfully and carefully designed, keeping the user's needs and comfort in mind.

No matter if you have no experience or you are well versed in finance, accounting and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you however experience any difficulty while using this template and you are not able to find the appropriate guidance in these instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and provide a brief explanation of your specific needs.

The model includes detailed assumptions for room rates, food and beverage services, and occupancy metrics. Users can adjust key inputs to reflect their specific acquisition scenarios and market conditions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Model Example, LBO Model Example, DCF Model Example, Hotel Industry Excel: Hotel Acquisition Financial Model Excel (XLSX) Spreadsheet, Profit Vision

This document is available as part of the following discounted bundle(s):

Save 34%!

Real Estate Acquisition Financial Models

This bundle contains 6 total documents. See all the documents to the right.